Empowerment

Empowerment

Gala

Empowerment Gala

Vision Statement

The Office of Equity, Inclusion, and Empowerment envisions a community in which residents enjoy a sense of well-being, safety, and self-sufficiency.

Mission Statement

The Office of Equity, Inclusion, and Empowerment seeks to provide programs and services which are geared toward addressing the following areas: homelessness, housing revitalization, housing affordability, mental health, substance abuse, and economic mobility. Programs will be designed to provide compassionate and effective services that support self-determination and resiliency to all in need by promoting equal access, cultural competency, ethics, and accountability through collaboration.

Empowerment Plan: Building Financial Freedom in East Point

Community Need

Most East Pointers with low-to-moderate incomes are facing significant financial literacy and credit-building challenges. Many have little to no knowledge of how credit works, and as a result, they are barely making ends meet. This often leads to poor credit ratings and cycles of financial instability. Prior experience has shown that many families lack the necessary education to make informed financial decisions, perpetuating poverty across generations.

Our Response

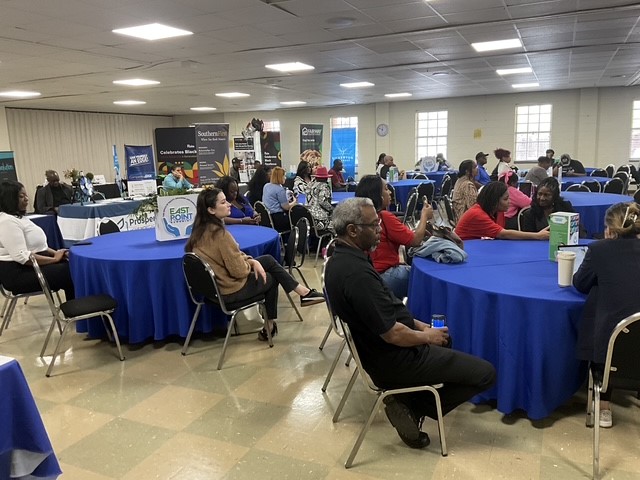

After careful consideration of the needs and demographics of our community, the City of East Point Office of Equity, Inclusion, and Empowerment created the Empowerment Plan. This initiative engages families and individuals in setting goals for financial freedom and long-term wealth building.

Our Framework

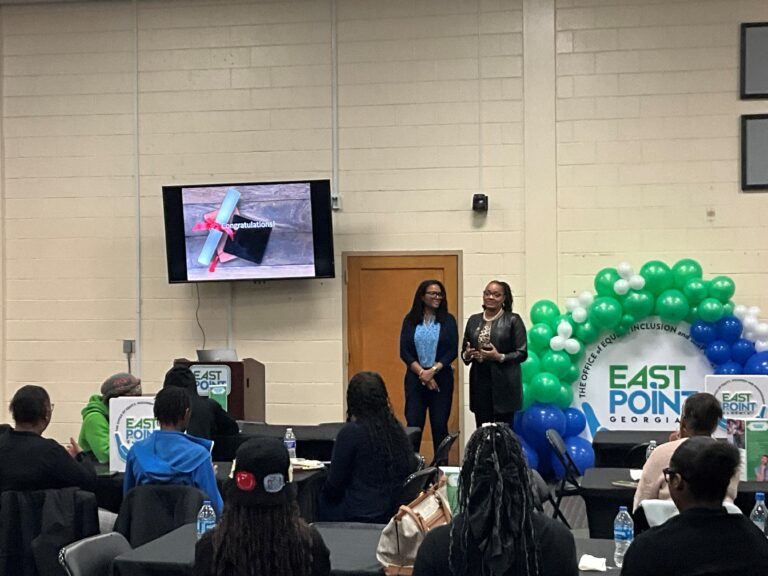

In November 2024, we launched the Empowered by Getting Ahead (EBGA) Framework in partnership with the African American Mayor Association’s Economic Mobility Institute (EMLI) and the National Center for Families Learning (NCFL).

- 25 residents enrolled in the first cohort, with 18 successfully completing the framework.

- In collaboration with the Urban League, an additional 35 residents graduated from the Homeownership Planning session.

- The framework included:

- Financial Literacy

- Homeownership Planning

- Wealth Building

- Credit Education

- Money Management & Budgeting

- Insurance Planning

- Workforce Development

- And more!

By March 2025, many graduates had been paired with financial coaches, given access to housing counselors, and began the pre-approval process for homeownership.

Upcoming 2025 Cohort

Our next cohort begins in July 2025 and concludes in December 2025. While continuing the same areas of focus, we are adding two new components to meet community needs:

- Communication Education – enhancing personal and professional communication skills.

- Parent Empowerment – strengthening families through effective parenting strategies.

These additions will empower participants to not only manage their finances but also build stronger family and community connections.

Innovation Through Collaboration

Due to increasing economic hardships, we are bringing together stakeholders and corporate sponsors to bridge gaps for East Point residents.

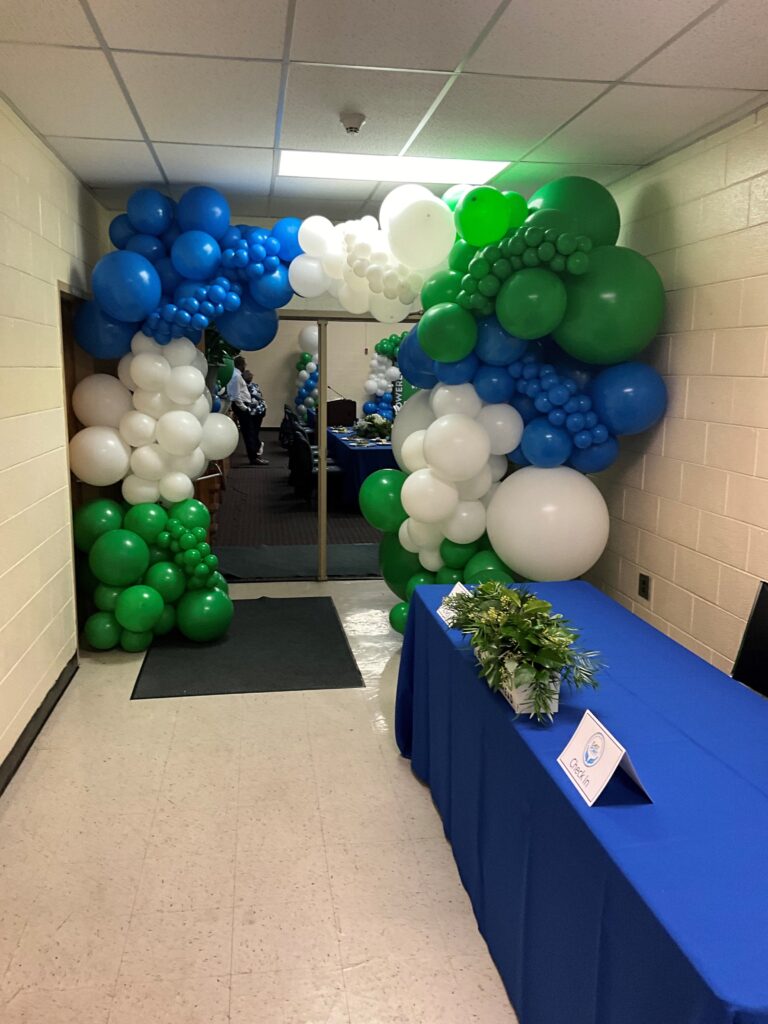

On Friday, January 30, 2026, at 7:30 p.m., the City of East Point Office of Equity, Inclusion, and Empowerment will host the Empowerment Gala at Sonesta Atlanta Airport 1325 Virginia Ave, Atlanta, GA 30344.

This will be a night to remember—an opportunity for community members, leaders, and partners to celebrate progress, strengthen connections, and invest in the future of East Point families.

City of East Point

Empowered by Getting Ahead Benchmarks

The benchmarks are used to measure each family’s success. This determines how well they have progressed during the course of the framework.

The benchmarks are used to measure each family’s success. This determines how well they have progressed during the course of the framework.

- Free of all cash welfare subsidies including food stamps, cash assistance, and housing

- Free of all cash welfare subsidies including food stamps, cash assistance, and housing

- Acquired employability skills

- Earned income, based on household size, that exceeds 200% of the Federal Poverty Guideline

- Established strong social capital and has knowledge of the ability to access appropriate community resources to prevent future crisis.

- Balanced household budget

- Reliable transportation

- Acceptable credit rating or approved credit repair plan

- Health insurance plan for all family members

- Safe and affordable housing

- Acquired employability skills

- Earned income, based on household size, that exceeds 200% of the Federal Poverty Guideline

- Established strong social capital and has knowledge of the ability to access appropriate community resources to prevent future crisis.

- Balanced household budget

- Reliable transportation

- Acceptable credit rating or approved credit repair plan

- Health insurance plan for all family members

- Safe and affordable housing

Free of all cash welfare subsidies including food stamps, cash assistance, and housing

Acquired employability skills

Earned income, based on household size, that exceeds 200% of the Federal Poverty Guideline

Established strong social capital and has knowledge of the ability to access appropriate community resources to prevent future crisis.

Balanced household budget

Reliable transportation

Acceptable credit rating or approved credit repair plan

Health insurance plan for all family members

Safe and affordable housing

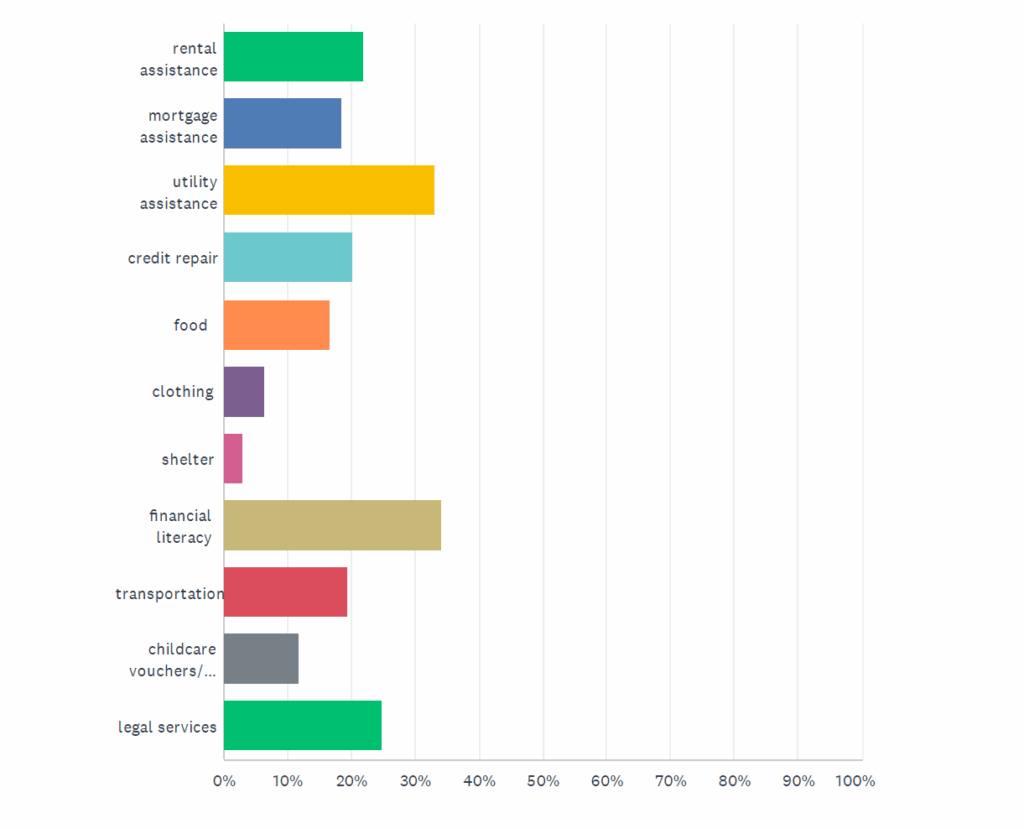

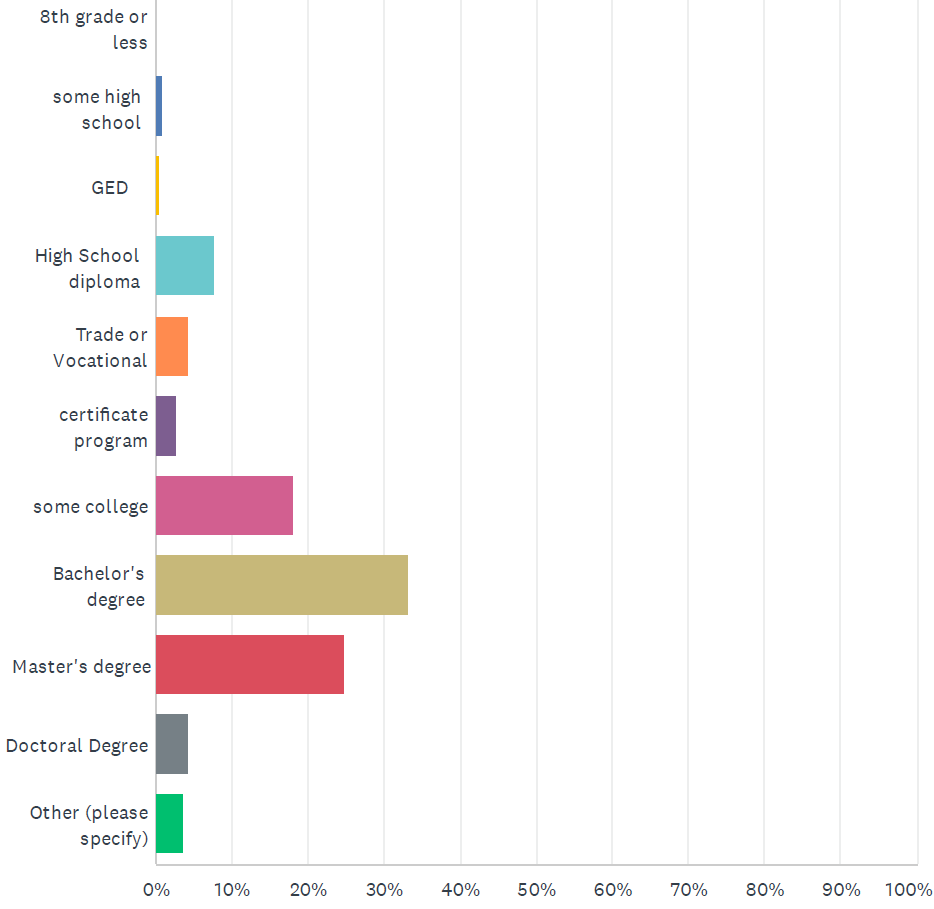

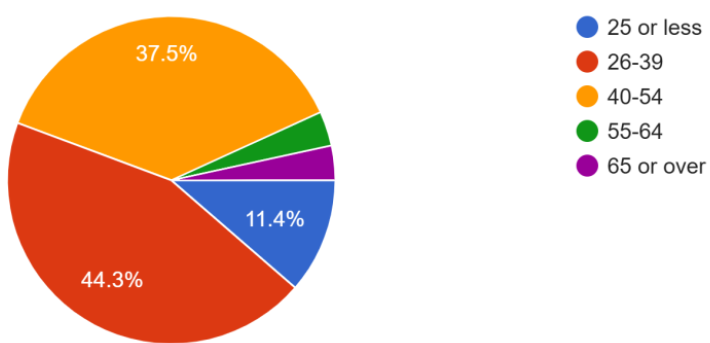

Client Data

2022 – 2024

2022 – 2024

Household Income

Age

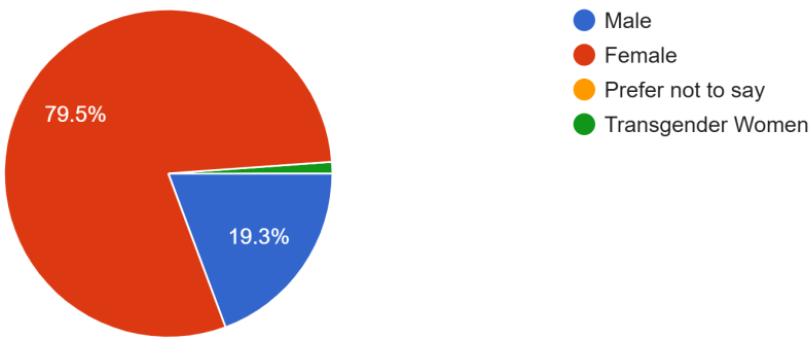

Sex

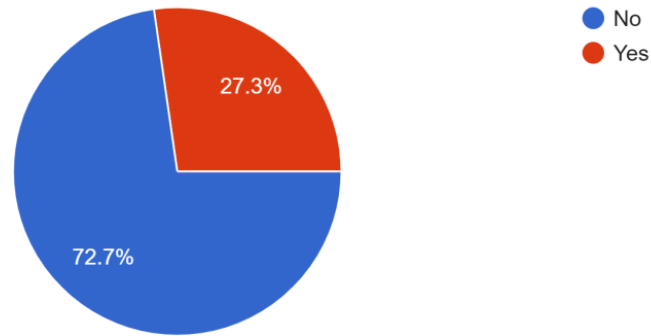

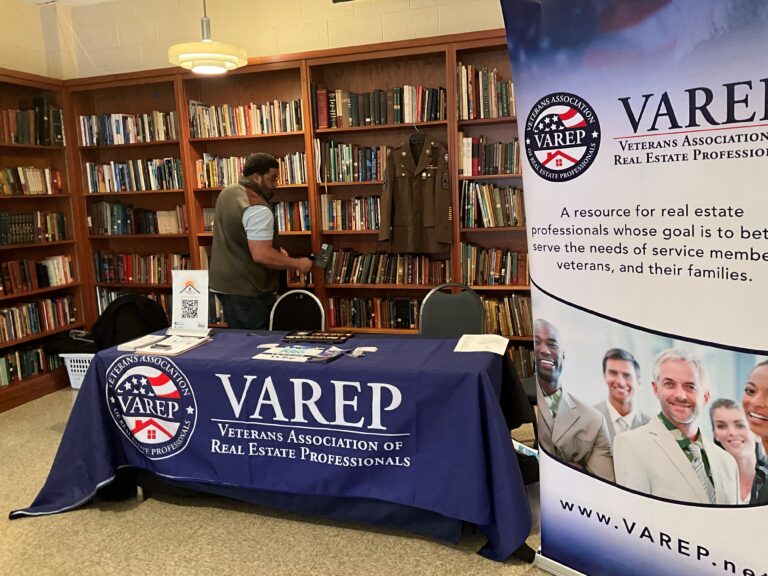

Veterans in Household

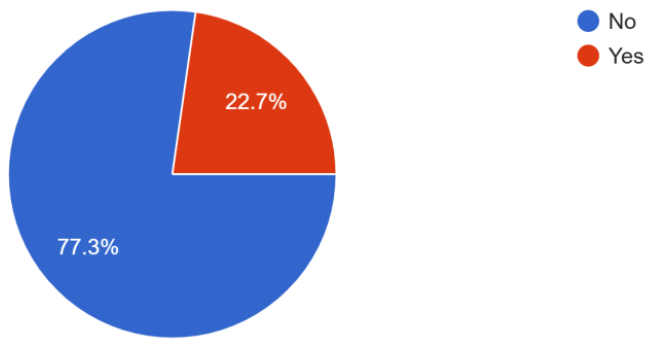

Household Members with Severe Mental Illness

Contact Us

Yolanda Johnson

Community Social Services Manager |

Office of Equity, Inclusion, and Empowerment

Office

Office

Michael Dimock M.A

Acting Director of Communications/EPTV Station Manager/Videographer

Office of Equity, Inclusion, and Empowerment